missouri vendor no tax due certificate

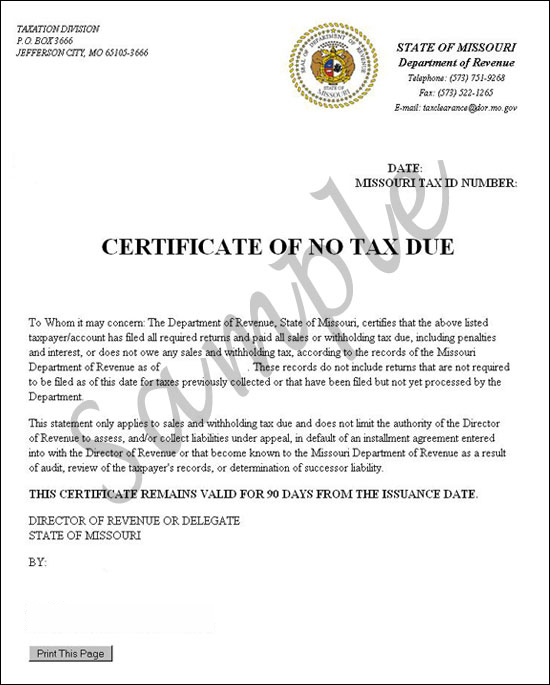

I require a sales or use tax Certificate of No Tax Due for the following. Notification from the Missouri Department of Revenue of the business entitys Missouri Employer Identification Number.

Non Convertible Debenture Subcription Agreement Between Bennett Colema Law Insider

Missouri Certificate Of No Tax DueAlexius hospital corp 1 notice number 2001943924 missouri id 18977901 june 19 2018.

. Missouri first adopted a general state sales tax in 1934 and since that time the rate has risen to 4225 percent. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. If you have questions concerning reinstatements please contact the.

Notification from the Missouri Department of Revenue of the business entitys Missouri Employer Identification Number. I require a sales or use tax Vendor No Tax Due to obtain or renew a contract with the state of Missouri. Select all that apply.

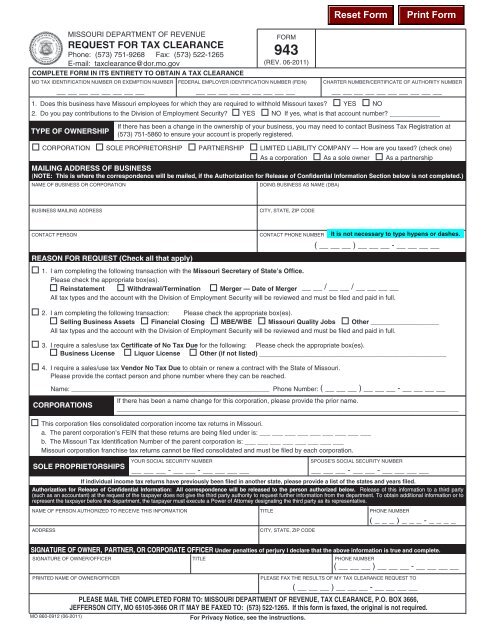

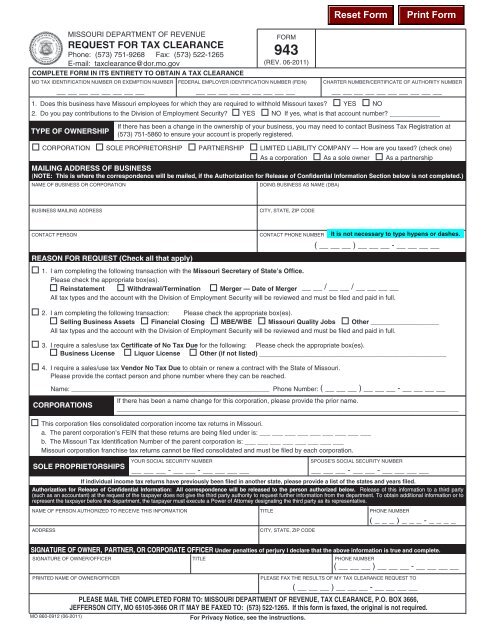

Local Government Tax Guide. Information available at httpdormogovforms943pdf. Local License Renewal Records and Online Access Request Form 4379A Request For Information or Audit of Local Sales and Use Tax Records 4379 Request For Information of State Agency License No Tax Due Online Access 4379B.

State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can re. Vendor Profile Service Area Commitment SAC indicating the geographic areas counties the applying provider plans to serve. The fax number is 573 522-1265.

A Vendor No Tax Due can be obtained by contacting. R Business License r Liquor License r Other if not listed 4. Information available at the.

If you are requesting a No Tax Due use No Tax Due Request Form 5522. Purchasing Vendors Annual Reports. Vendor No Tax Due.

340407 RSMo - SalesUse Tax Missouri statute regarding salesuse tax. Missouri Certificate Of No Tax DueCopy of evv electronic visit verification or telephony contract. Make sure both the FEIN and state EIN are included on the letter.

If you have questions concerning the tax clearance please contact the. No Tax Due Request. Current Vendor No Tax Due letter from the Missouri Department of Revenue.

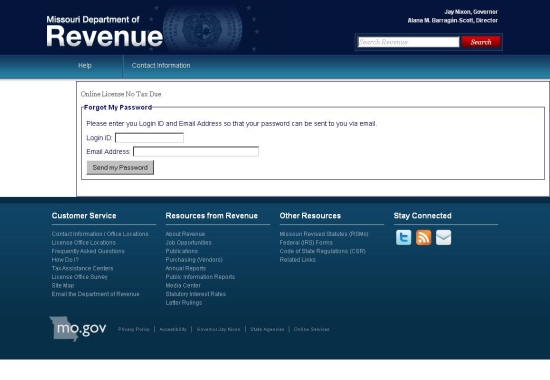

Select all that apply. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. If not required to be submitted submit a statement of explanation.

A business that makes retail sales must obtain a statement from the Department of Revenue stating no tax is due for state withholding tax and state sales tax before a city county or state agency will issue or renew any licenses required for conducting business where goods are sold at retail. If taxes are due depending on the payment history of the business a cashiers check or money order may be required for payment before a certificate of no tax due can be issued. Missouri statute regarding conflict of interest in selling to the state.

If you need a No Tax Due certificate for any other reason you can contact the Tax clearance Unit at 573-751-9268. Make sure both the FEIN and state EIN are included on the letter. Contact person Phone Number.

Form 5522 Revised 12-2021 F. Code of State Regulations Missouri code of state regulations CSR in regard to selling to the state. Local license renewal records and online access request form 4379a request for information or audit of local sales and use tax records 4379 request for information of state agency license no tax due online access 4379b.

2 any other documentation required to cure the dissolution for example all past due annual reports must be included if the corporation was. If you need a Full Tax Clearance please fill out a Request for Tax Clearance Form 943. I am required to provide a No Tax Due Certificate for the following reason.

All groups and messages. If a business license is not required submit a statement of explanation. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or salestaxexemptionsdormogov to request a Certificate of No Tax Due.

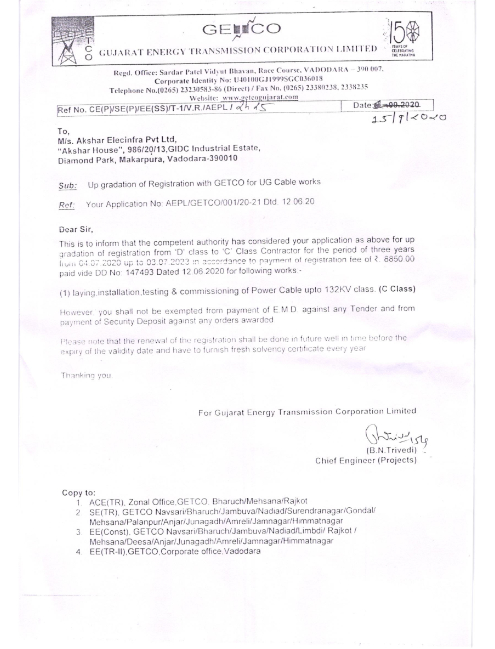

A Certificate of No Tax Due is NOT sufficient. Current Vendor No Tax Due certificate from Missouri Department of Revenue. The Missouri Department of Revenue will issue a Vendor No Tax Due when a business is properly registered and has all of its salesuse tax paid in full.

If the business is properly registered and does not owe any Missouri sales or withholding tax this site will allow you to print your own Certificate of No Tax Due which you can present to the local or state agency. Current Vendor No Tax Due letter from the Missouri Department of Revenue. Missouri Sales Use Tax Guide - Avalara Verified 6 minutes ago Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

Have a valid registration with the Missouri. In order for the business owner or authorized representative to obtain a no tax due through the online system the business must. How To Obtain A Certificate Of Vendor No Tax Due A Vendor No Tax Due certificate can be obtained from the Missouri Department of Revenue when a business pays all of its salesuse tax in full up to date does not have a sales tax delinquency or does not sell tangible personal property at retail in Missouri.

Missouri No Tax Due Statements Available Online. A Certificate of No Tax Due is NOT sufficient. R Business License r Liquor License r Other if not listed _____ 4.

I require a sales or use tax Certificate of No Tax Due for the following. Letter from the Missouri Department of Revenue. Information available at httpdormogovforms943pdf.

Missouri Department of Revenue Tax Clearance Unit at 573 751-9268.

Fax Letter A Big Collection Of Free Fax Letter Templates And Forms For Electronic And Paper F Letter Templates Cover Letter For Resume Letter Writing Samples

Free Pay Stub Template 09 Paycheck Employee Handbook Employee Handbook Template

Jci Internal Audit Checklist By Dr Mahboob Khan Phd Internal Audit Audit Checklist

Printable Resignation Letter By Employee Employer Acceptance Template Resignation Letter Employee Resignation Letter Printable Letter Templates

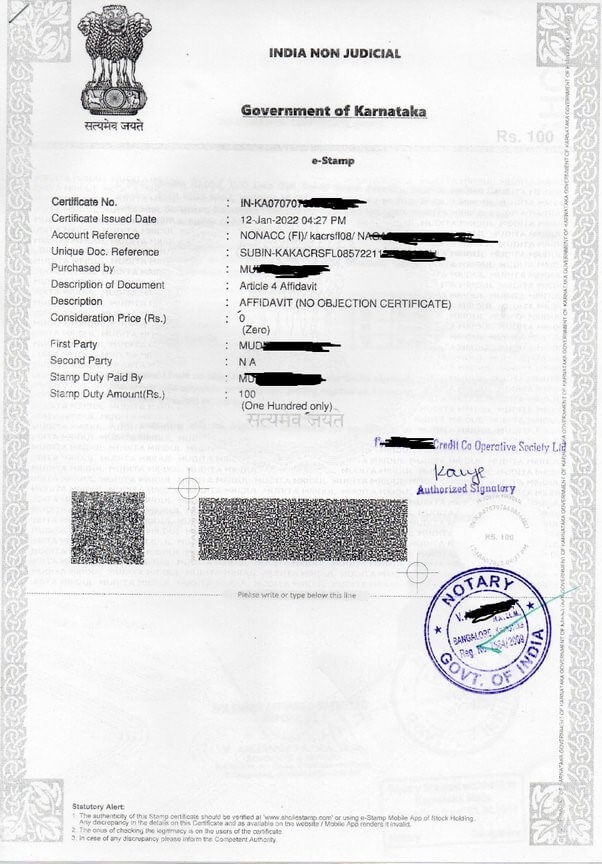

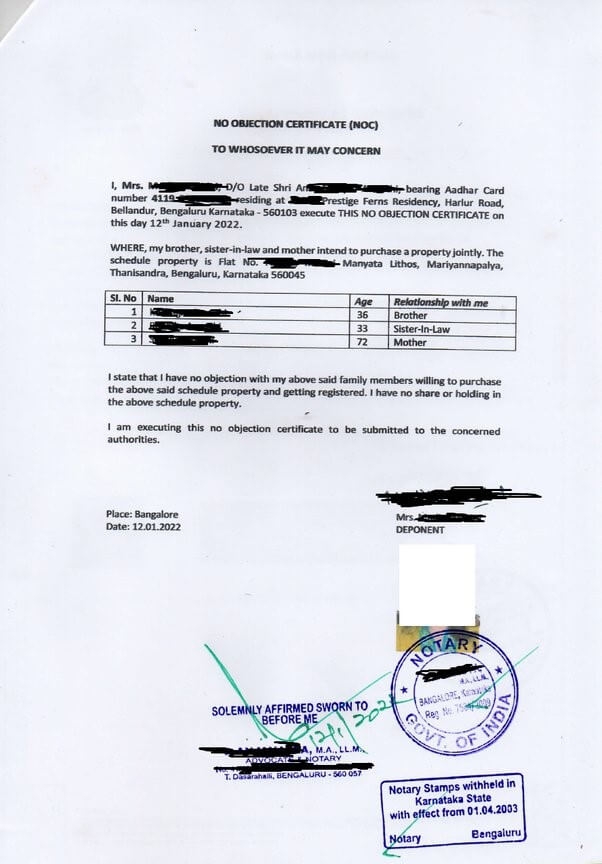

How To Get No Objection Certificate From Legal Heirs For Transfer Of Property In India

Non Convertible Debenture Subcription Agreement Between Bennett Colema Law Insider

Get Our Example Of Stationery Purchase Order Template Purchase Order Template Order Form Template Office Word

Louisiana Quit Claim Deed Form Quites Louisiana Louisiana Parishes

943 Request For Tax Clearance Missouri Department Of Revenue

Certificate Of Title Definition

Ontario Unanimous Shareholders Agreement Between Shareholders And Throughout Nominee Shareholder Agreement Template Agreement Templates Professional Templates

What Is The Difference Between Noc No Objection Certificate And Ndc No Due Certificate Quora

How To Get No Objection Certificate From Legal Heirs For Transfer Of Property In India